Risk Management Mastery: Protecting Your Capital Like a Pro

Your Capital Is Your Lifeline – Guard It Wisely

At Quant Tekel, we’ve seen thousands of traders transform their results with one simple shift: treating risk management as their top priority. The difference between profitable traders and those who struggle? It’s not about finding perfect entries – it’s about protecting what you have while growing it systematically.

The Shocking Truth About Trading Without Risk Management

Our research reveals that 90% of new traders ignore proper risk management – and it shows in their results. They focus on profits while forgetting that preserving capital is what keeps you in the game long enough to succeed.

But here’s the empowering news: you’re about to join the successful 10% who trade with confidence and control. Because when you master risk management, you don’t trade with fear – you trade with calculated precision.

The Foundation: Position Sizing That Preserves Your Future

The 1% Rule: Your Golden Standard

Never risk more than 1% of your account on a single trade. This isn’t just advice – it’s the difference between professional trading and gambling. Here’s why this works:

$10,000 Account Example:

- Maximum risk per trade: $100 (1%)

- You could lose 100 trades in a row (though that’s virtually impossible)

- Emotional stability: Small losses don’t trigger panic decisions

- Compound growth: Consistent small wins build massive accounts

The Math That Saves Accounts:

- Risk 1% per trade: Down 10% after 10 losses

- Risk 5% per trade: Down 40% after 10 losses

- Risk 10% per trade: Down 65% after 10 losses

Which trader survives to catch the winning streak?

Calculating Your Perfect Position Size

Don’t guess – calculate with precision:

Formula: Position Size = (Account Risk ÷ Trade Risk) ÷ Pip Value

Real Example:

- Account: $10,000

- Risk: 1% = $100

- Stop Loss: 50 pips

- Pip Value (EUR/USD): $10 per standard lot

- Position Size: ($100 ÷ 50) ÷ $10 = 0.2 lots

Advanced Calculation for Different Pairs:

- USD base pairs: Straightforward calculation

- Cross pairs: Account for exchange rates

- Exotic pairs: Consider wider spreads

- Indices/Commodities: Adjust for point values

Stop Loss Strategies That Save Trading Careers

1. Technical Stop Losses

Place stops beyond key levels – give your trades room to breathe:

Support/Resistance Stops:

- Below support for long trades

- Above resistance for short trades

- Add buffer for spreads and volatility

Moving Average Stops:

- Below 20 EMA for short-term trades

- Below 50 SMA for swing trades

- Dynamic adjustment as trade progresses

Pattern-Based Stops:

- Beyond pattern boundaries

- Outside recent highs/lows

- Clear invalidation points

2. Percentage-Based Stops

Fixed percentage from entry provides consistency:

Forex Majors:

- Scalping: 10-20 pips

- Day trading: 20-50 pips

- Swing trading: 50-100 pips

Indices:

- S&P 500: 0.5-1.5%

- DAX: 0.7-2%

- Nikkei: 1-2.5%

Commodities:

- Gold: $10-30 per ounce

- Oil: $1-3 per barrel

- Silver: $0.50-1.50 per ounce

3. Volatility-Based Stops

Use ATR (Average True Range) for market-adjusted stops:

- Stop = Entry ± (2 × ATR)

- Adapts to market conditions automatically

- Prevents premature exits in volatile markets

- Tightens in calm conditions

ATR Stop Example:

- EUR/USD ATR(14) = 0.0050

- Long entry at 1.0500

- Stop at 1.0500 – (2 × 0.0050) = 1.0400

Advanced Risk Management Techniques

Risk/Reward Optimization

Target minimum 1:2 risk/reward ratio – this is where math becomes your friend:

The Power of R:R:

- 1:1 R:R needs 50% win rate to break even

- 1:2 R:R needs only 33% win rate

- 1:3 R:R needs just 25% win rate

Real Trading Results:

- 40% win rate with 1:2 R:R = Profitable

- 30% win rate with 1:3 R:R = Profitable

- 60% win rate with 1:1 R:R = Barely profitable

Which would you choose?

Correlation Management

Avoid hidden risks that destroy accounts:

Positive Correlations (move together):

- EUR/USD and GBP/USD: 0.7+ correlation

- AUD/USD and NZD/USD: 0.8+ correlation

- Gold and Silver: 0.75+ correlation

Risk Adjustment Formula:

- Two positions with 0.8 correlation

- Reduce each position to 60% normal size

- Total risk remains controlled

Correlation Trading Rules:

- Never risk more than 2% across correlated positions

- Diversify across asset classes

- Monitor correlation changes daily

- Use correlation for confirmation, not multiplication

The Power of Trailing Stops

Lock in profits while staying in trends:

Manual Trailing Strategy:

- Move stop to breakeven at 1:1

- Trail by 50% of profit after 2:1

- Tighten as target approaches

Dynamic Trailing Methods:

- ATR-based: Trail by 2-3x ATR

- Percentage: Maintain 1-2% from highs

- Structure: Below previous swing lows

Trailing Stop Excellence:

- Captures trending moves fully

- Reduces emotional decisions

- Protects profits automatically

- Allows winners to run

Trading Psychology: Your Mental Stop Loss

Emotional control is risk management for your mind:

1. Pre-Planning: Your Shield Against Emotions

- Decide exits before entering

- Write down stop and target

- Screenshot your plan

- No deviation allowed

2. Acceptance: The Professional Mindset

- Every trade can be a loser

- Losses are business expenses

- Focus on process, not outcomes

- Celebrate good trades, not just winners

3. Consistency: Your Superpower

- Same rules regardless of recent results

- No revenge trading after losses

- No overconfidence after wins

- Systematic approach always

4. Patience: The Ultimate Edge

- Wait for A+ setups only

- Quality over quantity

- Better to miss than force

- Opportunities are infinite

Real Traders, Real Results: Success Stories

Sarah from Sydney: “Following the 1% rule changed everything. I went from blowing accounts to consistent 5-10% monthly returns. Risk management gave me the confidence to trade without fear.”

Marcus from Munich: “Risk management was my breakthrough. Now I trade without fear because I know exactly what I’m risking. My worst month is -3%, my best +18%.”

Chen from Singapore: “Correlation management saved my account. I was risking 5% without knowing it. Now I understand true portfolio risk.”

Your Quant Tekel Risk Management Toolkit

We provide everything you need to trade safely:

Advanced Order Types:

- Stop loss with guaranteed execution

- Take profit with partial closes

- Trailing stops with custom parameters

- One-cancels-other (OCO) orders

Risk Calculators:

- Built into MT5 and DXtrade

- Position size calculator

- Risk/reward analyzer

- Correlation matrix tool

Real-Time Monitoring:

- Track exposure across all positions

- Account risk percentage display

- Drawdown alerts

- Margin level warnings

Education Resources:

- Weekly risk management webinars

- Personal risk profile assessment

- Advanced position sizing strategies

- Psychology coaching sessions

The Professional’s Risk Management Checklist

Before every trade, ask yourself:

- [ ] Is my risk 1% or less?

- [ ] Is my risk/reward at least 1:2?

- [ ] Have I checked for correlations?

- [ ] Is my stop at a logical level?

- [ ] Am I following my plan, not emotions?

- [ ] Would I take this trade if it was my last?

- [ ] Can I afford to lose this amount?

- [ ] Is this an A+ setup or am I forcing it?

Building Your Risk Management Fortress

Month 1-3: Foundation

- Master the 1% rule religiously

- Practice position sizing daily

- Track every trade meticulously

- Focus on consistency over profits

Month 4-6: Optimization

- Optimize risk/reward ratios

- Implement correlation management

- Develop trailing stop strategies

- Refine your approach

Month 7-12: Mastery

- Implement advanced techniques

- Automate where possible

- Mentor others

- Scale with confidence

Year 2+: Professional Level

- Manage multiple strategies

- Dynamic risk adjustment

- Portfolio approach

- Consistent profitability

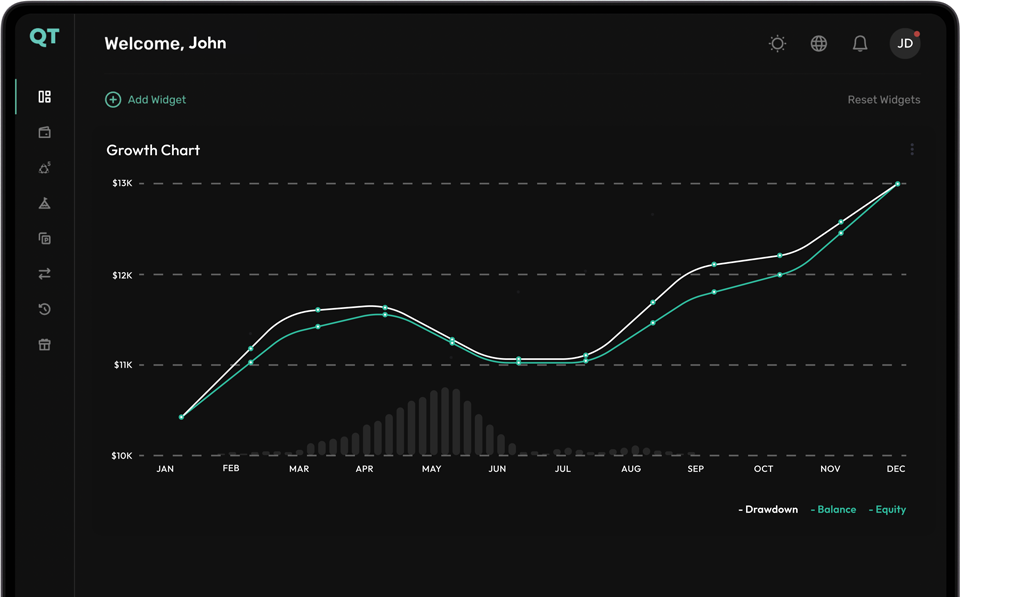

The Compound Effect of Good Risk Management

Watch how proper risk management transforms results:

Scenario 1: Poor Risk Management

- Starting capital: $10,000

- Risk per trade: 5%

- Monthly trades: 20

- Win rate: 50%

- Result: Account blown in 6 months

Scenario 2: Professional Risk Management

- Starting capital: $10,000

- Risk per trade: 1%

- Monthly trades: 20

- Win rate: 50%

- Result: Steady growth, $18,000 after 1 year

Same win rate, completely different outcomes.

Your Partner in Protected Profitability

With Quant Tekel’s streamlined systems and world-class support, you’re never alone in your risk management journey. Our team is available 24/7 to help you implement these strategies effectively.

We work hard to make trading better for you by providing:

- Enhanced transparency in execution

- Simplified payout systems

- Professional-grade risk tools

- Continuous education and support

Remember: The goal isn’t to avoid all losses – it’s to ensure your winners more than compensate for them. With proper risk management, you’re not gambling; you’re running a professional trading business.

Every professional trader will tell you the same thing: they wish they’d focused on risk management sooner. Don’t wait. Start protecting your capital like a pro today.

Ready to trade with the confidence that comes from bulletproof risk management? Join Quant Tekel today and discover why protected capital is profitable capital.

Take control of your trading destiny. With up to $200,000 in virtual capital and profit sharing up to 90%, Quant Tekel is your partner in achieving sustainable trading success.