Market Sentiment Analysis: Reading the Mind of the Market

Beyond Charts: Understanding What Really Moves Markets

Welcome to the next level of trading mastery. At Quant Tekel, we believe that while technical analysis shows you what’s happening, sentiment analysis reveals why it’s happening. Master this powerful approach, and you’ll trade with the confidence that comes from truly understanding market dynamics.

Every price movement tells a story of human emotion – fear, greed, hope, and despair. Learning to read these emotions gives you an edge that most traders never achieve. Today, we’ll unlock the secrets of market sentiment and show you how to profit from the psychology of the masses.

The Hidden Force Behind Every Market Move

Think about it: behind every trade is a human decision (or an algorithm programmed by humans). These decisions are driven by emotions, expectations, and reactions to events. When you understand the collective mood of the market, you can anticipate moves before they show up on charts.

Market sentiment is like the ocean’s current – invisible on the surface but powerfully directing everything that floats on it. Master traders don’t fight the current; they understand it and use it to their advantage.

Decoding Market Psychology: The Sentiment Indicators

1. The VIX: The Market’s Fear Gauge

Often called the “fear index,” the VIX measures expected volatility in the S&P 500. But it’s much more than that – it’s a window into trader psychology:

VIX Levels and What They Mean:

- Below 15: Extreme complacency, markets calm

- 15-20: Normal conditions, balanced sentiment

- 20-30: Elevated concern, opportunities emerging

- 30-40: High fear, potential reversal zones

- Above 40: Extreme fear, capitulation possible

Pro Strategy: VIX Divergence Trading When markets make new highs but VIX refuses to drop below 15, it signals hidden concern. When markets plunge but VIX won’t exceed 30, it suggests limited downside.

Real Example (December 2024):

- S&P 500 at all-time highs

- VIX stuck above 18 (should be below 15)

- Result: January 2025 correction of 8%

2. Put/Call Ratio: The Options Oracle

This ratio reveals where smart money is positioned by comparing bearish bets (puts) to bullish bets (calls):

Reading the Ratio:

- Above 1.2: Extreme bearishness (contrarian bullish)

- 1.0-1.2: Moderate bearishness

- 0.8-1.0: Neutral sentiment

- 0.6-0.8: Moderate bullishness

- Below 0.6: Extreme bullishness (contrarian bearish)

Advanced Application: Don’t just look at the absolute number – watch the trend:

- Rising ratio + rising market = Healthy skepticism

- Falling ratio + rising market = Dangerous complacency

- Rising ratio + falling market = Capitulation near

3. Commitment of Traders (COT) Report: Following Smart Money

This weekly report shows positions of three trader groups:

Commercial Hedgers (The Smart Money):

- Actual producers/consumers of commodities

- Trade based on business needs

- Often early in major turns

Large Speculators (The Trend Followers):

- Hedge funds and CTAs

- Follow trends aggressively

- Good for confirmation

Small Speculators (The Crowd):

- Retail traders

- Often wrong at extremes

- Useful contrarian indicator

How to Use COT Data:

- Watch for extremes in positioning

- Note when commercials disagree with speculators

- Look for shifts in long-term positioning

- Combine with technical analysis

Economic Calendar: Your Sentiment Roadmap

Major events create sentiment shifts. Here’s how to trade them:

High-Impact Events That Move Markets

Central Bank Decisions:

- Interest rate changes

- Policy statement language

- Economic projections

- Press conference tone

Trading Strategy: Position 24-48 hours before, exit partially on news, hold runners for follow-through.

NFP (Non-Farm Payrolls):

- Released first Friday monthly

- Massive volatility trigger

- Affects USD pairs heavily

- Sets tone for the month

Trading Strategy: Avoid trading 30 minutes before/after. Trade the established direction after dust settles.

Inflation Data (CPI/PPI):

- Shapes rate expectations

- Drives bond yields

- Affects all markets

- Critical in 2025 environment

Trading Strategy: Trade currency pairs based on inflation differentials between countries.

Trading the Calendar Like a Pro

Pre-Event Positioning:

- Check consensus expectations

- Assess current market positioning

- Plan for both scenarios

- Set wider stops for volatility

During the Event:

- Don’t chase initial spikes

- Wait for clear direction

- Watch for reversals

- Let others fight in chaos

Post-Event Opportunity:

- Trade established trend

- Look for continuation patterns

- Monitor sentiment shift

- Ride multi-day moves

Central Banks: The Ultimate Market Movers

Understanding central bank psychology is your key to major moves:

The Fed Factor (USD)

Hawkish Signals (USD Positive):

- “Inflation remains elevated”

- “Further tightening may be appropriate”

- “Labor market remains tight”

- Dot plot showing higher rates

Dovish Signals (USD Negative):

- “Data dependent” (uncertainty)

- “Monitoring developments”

- “Balanced risks”

- Pause in rate hikes

ECB Dynamics (EUR)

The ECB faces unique challenges:

- Fragmented economies

- Inflation disparities

- Political pressures

- Energy concerns

Trading ECB Decisions: Watch for surprises versus expectations. Markets often overreact to ECB, creating fade opportunities.

Bank of Japan (JPY)

The wildcard of central banks:

- Decades of easy policy

- Yield curve control

- Intervention threats

- Policy shift potential

JPY Trading in 2025: Any hint of policy normalization sends JPY soaring. Watch for subtle language changes.

Social Sentiment: The Modern Edge

In 2025, social media sentiment provides real-time market psychology:

Twitter/X Trading Community

Monitor for:

- Trending trading hashtags

- Influencer sentiment shifts

- Retail capitulation posts

- Euphoria indicators

Red Flags of Tops:

- “This time is different”

- “Stocks only go up”

- Leverage bragging

- New trader explosion

Bottom Signals:

- “I’m done with trading”

- “Markets are rigged”

- Capitulation posts

- Silence from bulls

Reddit and Trading Forums

Valuable for:

- Retail positioning

- Meme stock movements

- Sentiment extremes

- Crowd psychology

Contrarian Trading: When Everyone’s Wrong

The crowd is often wrong at extremes. Here’s how to profit:

Identifying Sentiment Extremes

Extreme Bullishness (Consider Shorts):

- Magazine covers featuring markets

- Taxi drivers giving tips

- 90%+ bulls in surveys

- Record call buying

- Leverage at extremes

Extreme Bearishness (Consider Longs):

- “End of world” headlines

- Record put buying

- Cash levels at highs

- Capitulation volume

- Universal pessimism

The Art of Fading the Crowd

Rules for Contrarian Trading:

- Wait for extremes (not just “high” sentiment)

- Require technical confirmation

- Use tight stops (crowd can stay wrong)

- Scale in gradually

- Take profits systematically

Practical Sentiment Strategies

Strategy 1: Sentiment Divergence

When price and sentiment disagree, opportunities emerge:

Bullish Divergence:

- Price making lower lows

- Sentiment improving (less bearish)

- Volume declining on selloffs

- Smart money accumulating

Bearish Divergence:

- Price making higher highs

- Sentiment deteriorating

- Volume declining on rallies

- Distribution patterns

Strategy 2: Sentiment Extremes Fade

Trade against the crowd at extremes:

- Identify extreme reading (90%+ bulls/bears)

- Wait for price to stop moving with sentiment

- Enter on first reversal signal

- Stop beyond extreme

- Target mean reversion

Strategy 3: Event-Driven Sentiment

Trade sentiment shifts around known events:

- Mark major events on calendar

- Note pre-event sentiment

- Plan for surprise outcomes

- Trade the new trend

- Hold for follow-through

Building Your Sentiment Analysis Toolkit

Essential resources for mastering sentiment:

Free Tools:

- Economic calendars (ForexFactory, Investing.com)

- COT reports (CFTC website)

- Fear & Greed Index (CNN)

- Put/Call ratios (CBOE)

- Social sentiment (Twitter, Reddit)

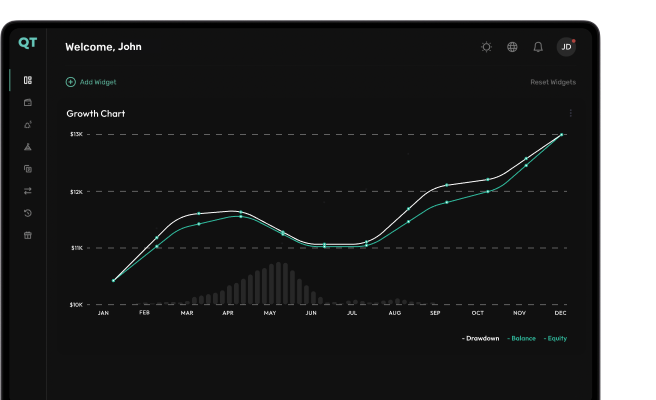

Professional Tools (via Quant Tekel):

- Real-time sentiment indicators

- Integrated economic calendar

- Community positioning data

- Sentiment alerts

- Expert analysis

Real-World Application: EUR/USD Case Study

January 2025 ECB Meeting Analysis:

Pre-Meeting Sentiment:

- COT showed record speculator shorts

- Put/Call ratio at 1.4 (extreme bearish)

- Social media universally bearish EUR

- VIX elevated despite calm markets

The Event:

- ECB less dovish than expected

- Mentioned “upside inflation risks”

- Market positioned wrong way

The Trade:

- Entry: 1.0420 on sentiment shift

- Stop: 1.0350 (below support)

- Target: 1.0720 (previous resistance)

- Result: 300 pips in 5 days

Lessons:

- Extreme sentiment created opportunity

- Positioning mattered more than news

- Follow-through confirmed sentiment shift

- Patient entry improved risk/reward

Your 30-Day Sentiment Mastery Plan

Week 1: Foundation

- Study economic calendar daily

- Track VIX levels

- Note sentiment at market turns

- Start sentiment journal

Week 2: COT Analysis

- Download weekly COT reports

- Chart commercial positions

- Compare to price action

- Identify extremes

Week 3: Social Integration

- Monitor trading Twitter

- Check Reddit sentiment

- Note influencer shifts

- Track retail behavior

Week 4: Live Application

- Combine all tools

- Trade one sentiment setup

- Analyze results

- Refine approach

The Professional’s Sentiment Mindset

Remember these principles:

Sentiment is a Tool, Not a System:

- Confirms other analysis

- Provides context

- Identifies extremes

- Times entries better

Context Always Matters:

- Consider the trend

- Check multiple indicators

- Verify with price action

- Respect risk management

Patience Pays:

- Wait for extremes

- Don’t force trades

- Let sentiment develop

- Trade with conviction

The Quant Tekel Sentiment Edge

We provide exclusive tools for sentiment mastery:

Real-Time Integration:

- Economic calendar in platform

- Sentiment indicators overlay

- Community positioning data

- News feed with sentiment

Educational Excellence:

- Weekly sentiment webinars

- COT report analysis

- Central bank guides

- Psychology coaching

Community Intelligence:

- 40,000+ traders sharing insights

- Real-time sentiment shifts

- Collective wisdom

- Success stories

Mastering the Mind of the Market

Sentiment analysis transforms your trading because it reveals the ‘why’ behind price moves. When you understand what drives other traders, you can position yourself ahead of the crowd.

At Quant Tekel, we believe in empowering traders with every possible edge. Sentiment analysis is one of the most powerful tools in your arsenal – use it wisely, and watch your results transform.

Ready to see markets through a new lens? Join Quant Tekel and discover how understanding market psychology transforms your trading results. When you know what others are thinking, you’re always one step ahead.

Take your trading to the next level with advanced sentiment analysis tools, expert education, and a community of successful traders. Quant Tekel – your partner in achieving trading success.