Trading

Stocks

Speculate on 5,000+ international stocks via CFDs — go long or short with leverage up to 1:20,

competitive pricing, and 24/5 trading access.

Why trade Stocks

with quant tekel

Capital-Efficient Exposure

Trade large positions with a small deposit. CFDs give full exposure without owning the underlying shares.

Ultra-Low Commission Costs

US stock CFDs from $0.02/share (min $10), and comparable fees on international shares.

Unlimited Directional Flexibility

Go long or short — profit from rising and falling markets without ownership.

Extended Trading Hours

Access over 5,000 stocks, including 80+ US names in extended hours trading.

Secure & Regulated

CFDs are regulated, your funds are held separately, and protections like negative-balance exist.

Diversified Global Access

Trade US, UK, EU, and Asia-Pacific stocks — all from one platform. Diversify across sectors and regions with ease.

Trade Every

Market Opportunity

TSLA/USD

Tesla

- Spread from 1.0 pips

- High volatility during earnings and product news

- Strong correlation with tech sentiment

- Great for momentum and breakout strategies

AAPL/USD

Apple

- Spread from 0.1 pips

- Mega-cap with stable price behavior

- High daily trading volume

- Ideal for swing trades and portfolio anchors

AMZN/USD

Amazon

- Spread from 0.0 pips

- Retail + cloud business model

- Moves on Fed announcements and consumer data

- Flexible for both intraday and long-term setups

MSFT/USD

Microsoft

- Spread from 0.2 pips

- Strong fundamentals + AI leadership

- Blue-chip with steady price action

- Great for conservative, longer-hold trades

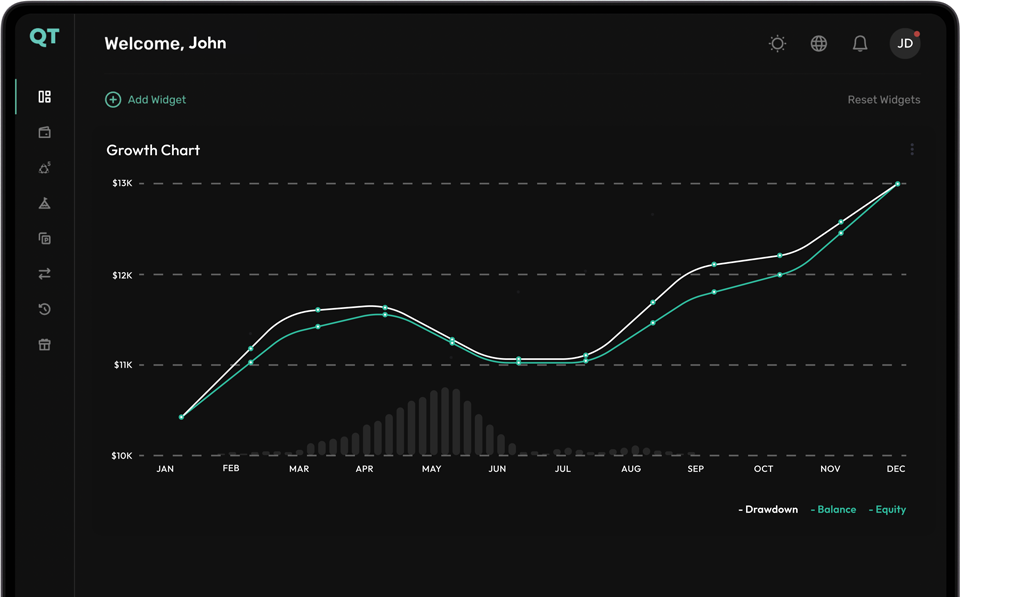

your Stocks Journey

Begins here

At Quant Tekel, we provide aspiring traders with the resources they need to succeed. Our innovative programs are designed to elevate your trading journey.

Step 1

Choose your account

Choose from Standard, Prime and Elite account, depending on your trading preferences to get started

Step 2

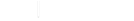

Select Your Platform

Select from Tradelocker, MT5, or cTrader. All platforms are completely available to use for trading.

Step 3

Fund Your Account

Enjoy a variety of deposit methods that offer instant processing. You can begin with an initial deposit of just $200.

Step 4

Start Trading

Gain immediate access to over 80 currency pairs and 24/5 market access. Your exciting trading journey starts right now!

Everything you need

to make it in the markets

- Beginner’s Guide

- Technical Analysis

- Fundamental Analysis

- Risk Management

What Is Stock Trading?

It’s buying or speculating on shares of public companies like Apple, Tesla, or Amazon.

How Do Stock CFDs Work?

You don’t own the stock — you trade on its price movement with leverage and flexibility.

What Moves Stock Prices?

Earnings reports, economic data, interest rates, news, and overall market sentiment.

What’s the Difference Between

Stocks and CFDs?

Stocks give ownership. CFDs let you go long or short without owning the underlying asset.

How Does Leverage Work

in Stocks?

Leverage lets you control larger trades with less capital. QT offers up to 1:20.

Is Stock Trading Risky?

Yes — especially with leverage. Always manage your exposure and use stop-losses.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.