Trading

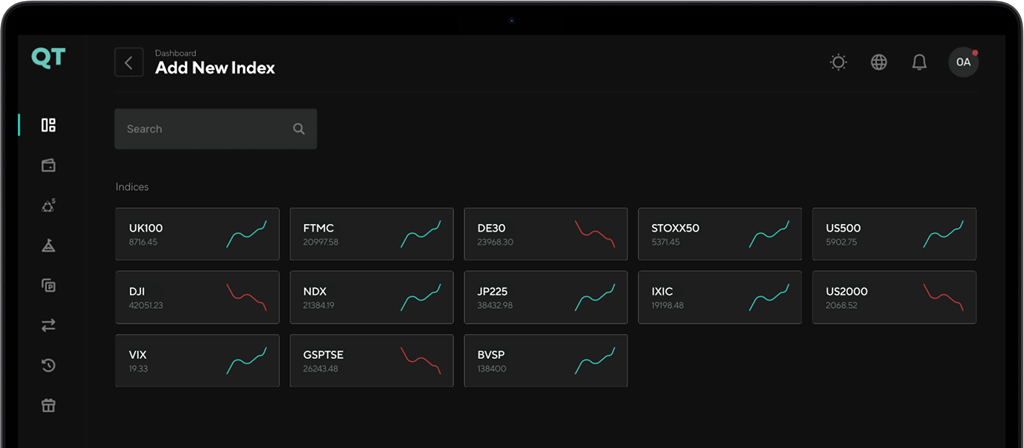

Indices

Speculate on 5,000+ international stocks via CFDs — go long or short with leverage up to 1:20,

competitive pricing, and 24/5 trading access.

Why trade Indices

with quant tekel

Lightning-Fast Execution

Execute trades in under 10ms across major global indices — from S&P 500 to DAX. Direct routing ensures speed and accuracy.

Ultra-Competitive Spreads

Trade with spreads from 0.5 pts on top indices like US30, NAS100, and GER40 — with no hidden commissions.

Magnify Every Move

Access leverage up to 1:100, allowing you to trade big macro trends with minimal upfront capital.

Go Long or Short

Speculate on rising or falling indices — no need to own individual stocks, just pure market direction.

Regulated & Confidential

Your funds are protected in tier-1 segregated bank accounts. QT follows strict compliance and capital safety practices.

24/7 Market Access

Trade major sessions across the US, Europe, and Asia — including key futures hours for extended access.yes i

Trade Every

Market Opportunity

US30/USD

Dow Jones Industrial Average

- Spread from 1.0 pips

- Tracks 30 major US companies

- Reacts to earnings, interest rates, and GDP data

- Ideal for intraday and swing trading strategies

NAS100/USD

NASDAQ 100

- Spread from 0.8 pts

- Tech-heavy index with high volatility

- Influenced by big names like Apple, Nvidia, Meta

- Great for momentum and trend-following setups

SPX500/USD

S&P 500

- Spread from 0.6 pts

- Broad US market exposure (500 largest companies)

- Less volatile, good for steady growth setups

- Perfect for macro and long-term positioning

GER40/USD

DAX (Germany)

- Spread from 1.0 pts

- Core EU market index

- Sensitive to EU inflation and ECB policy

- Excellent for early European session trades

your Indices Journey

Begins here

At Quant Tekel, we provide aspiring traders with the resources they need to succeed. Our innovative programs are designed to elevate your trading journey.

Step 1

Choose your account

Choose from Standard, Prime and Elite account, depending on your trading preferences to get started

Step 2

Select Your Platform

Select from Tradelocker, MT5, or cTrader. All platforms are completely available to use for trading.

Step 3

Fund Your Account

Enjoy a variety of deposit methods that offer instant processing. You can begin with an initial deposit of just $200.

Step 4

Start Trading

Gain immediate access to over 80 currency pairs and 24/5 market access. Your exciting trading journey starts right now!

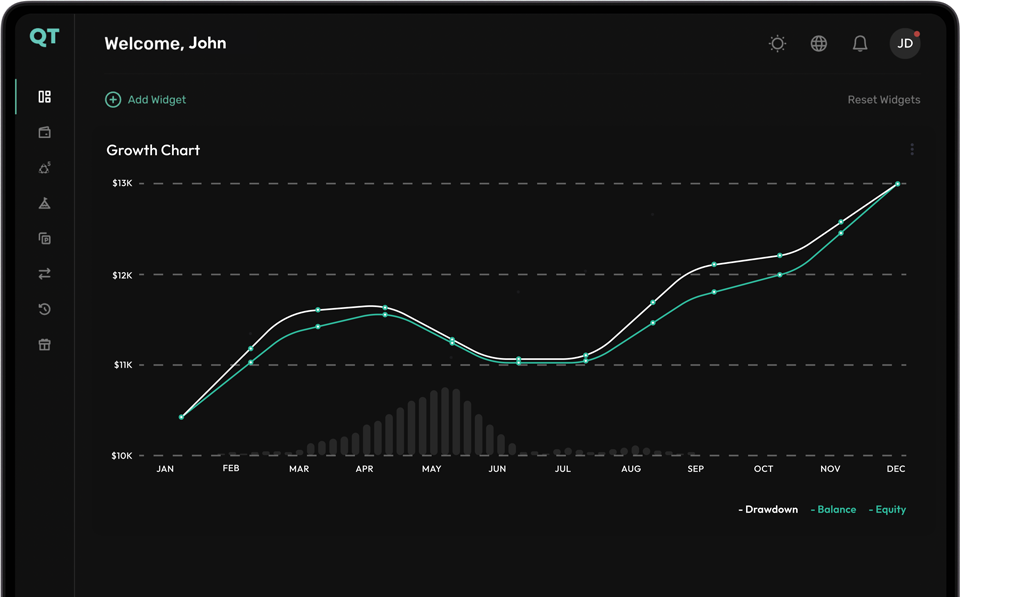

Everything you need

to make it in the markets

- Beginner’s Guide

- Technical Analysis

- Fundamental Analysis

- Risk Management

What Is Index Trading?

It’s speculating on the performance of a group of stocks — like the S&P 500 or NASDAQ 100.

How Do Index CFDs Work?

You trade on the index price without owning individual stocks — with the ability to go long or short.

What Moves Index Prices?

Economic reports, company earnings, interest rates, and overall market sentiment drive movements.

Why Trade Indices Over Stocks?

They offer broader exposure, lower volatility than single stocks, and reflect whole economies or sectors.

Is Index Trading Risky?

Yes — index moves are smoother but still volatile. Use proper risk controls and stop-losses.

How Does Leverage Work in Indices?

Leverage lets you trade larger index positions with less capital. QT offers up to 1:100.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.