Trading

Commodities

Tap into 30+ commodity classes — spot or futures — via CFDs. Go long or short on gold, oil, wheat,

and more. Enjoy spread from 0.1 pts (gold), leverage up to 1:50, and 24/5 market access.

Why trade Commodities

with quant tekel

Diverse Market Exposure

Trade across energy, precious metals, soft commodities, and agricultural futures — all from a single platform.

Competitive Pricing

Keep costs down with tight spreads — gold from 0.1 pts, Brent from 2.8 pts, plus zero commissions on spot CFDs.

Balanced Risk & Reward

Leverage enhances opportunities: trade larger positions with margin as low as 2%, up to 1:50.

Flexible Trading

Go long or short — profit whether commodity prices rise or fall, ideal for spot, futures, and options.

Risk Control

Manage your exposure with a wide range of platform-based tools — from contingent and stop-loss orders to customised automation and advanced strategy settings.

Real-Time Market Insights

Stay ahead with integrated news, sentiment analysis, and live commodity price feeds — directly on your platform.

Trade Every

Market Opportunity

GOLD/USD

Precious metal

- Spread from 0.1 pips

- Safe-haven asset during geopolitical/inflation shocks

- Fluid relationship with USD

- Popular for hedge positions and long-term balance

BRENT/USD

Crude Oil

- Futures spread from 2.8 pts; spot from 6 pts

- Highly sensitive to supply/demand shocks

- Great for macro and geopolitical trading

- Suitable for day traders and longer-term positions

WTI/USD

US Crude

- Spot vs futures pricing option

- Use leverage to trade economic and inventory updates

- Highly liquid global energy benchmark

- Useful for intraday breakout strategies

SILVER/USD

Industrial & Investment Metal

- Spread tightness via continuous charting

- Dual role: industrial demand + inflation hedge

- Often amplifies gold crossover moves

- Great for tactical short-term plays

your Commodities Journey

Begins here

At Quant Tekel, we provide aspiring traders with the resources they need to succeed. Our innovative programs are designed to elevate your trading journey.

Step 1

Choose your account

Choose from Standard, Prime and Elite account, depending on your trading preferences to get started

Step 2

Select Your Platform

Select from Tradelocker, MT5, or cTrader. All platforms are completely available to use for trading.

Step 3

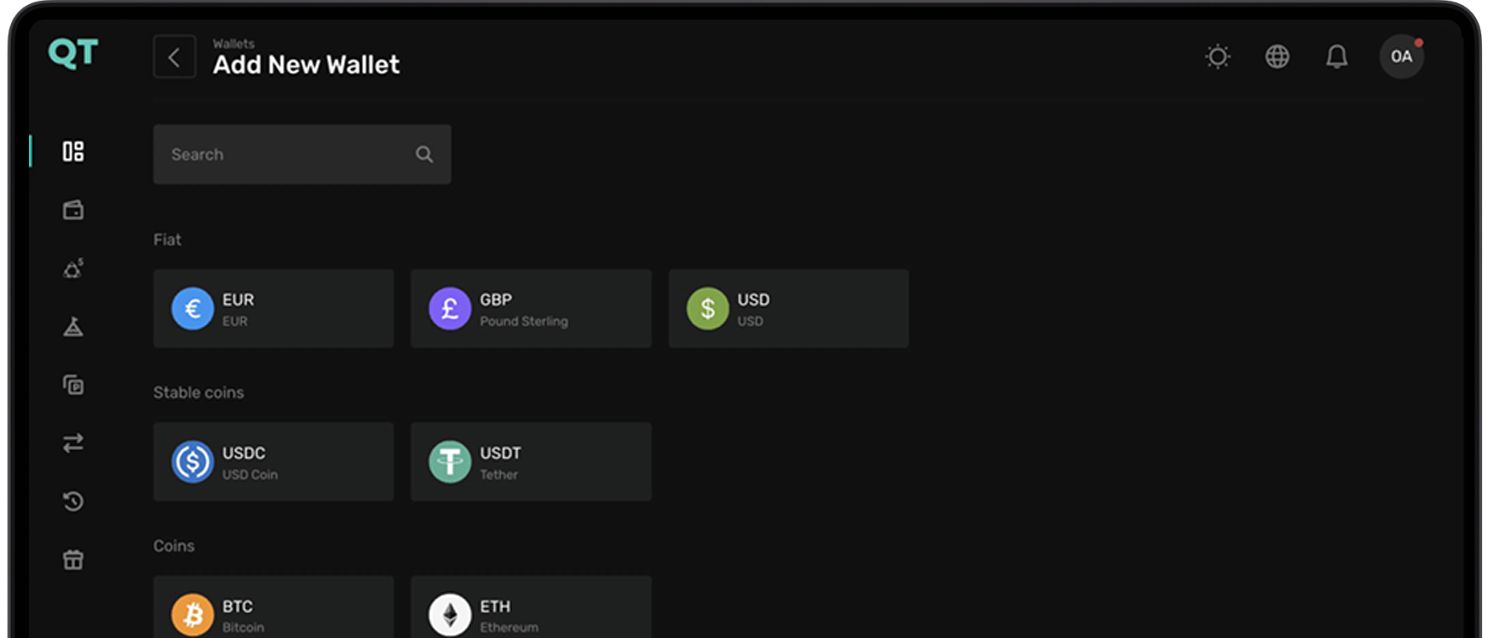

Fund Your Account

Enjoy a variety of deposit methods that offer instant processing. You can begin with an initial deposit of just $200.

Step 4

Start Trading

Gain immediate access to over 80 currency pairs and 24/5 market access. Your exciting trading journey starts right now!

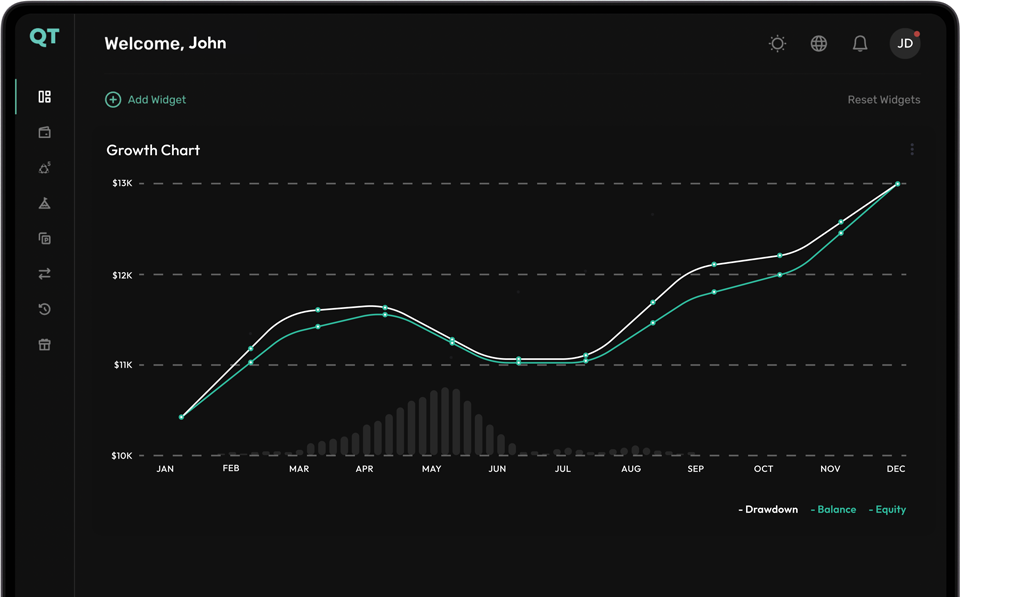

Everything you need

to make it in the markets

- Beginner’s Guide

- Technical Analysis

- Fundamental Analysis

- Risk Management

What Is Commodity Trading?

It’s trading raw materials like gold, oil, and wheat — without owning the physical asset.

How Do Commodity CFDs Work?

You speculate on price changes using contracts — go long or short with leverage, no storage needed.

What Moves Commodity Prices?

Supply and demand, weather, geopolitical events, and inventory reports all affect pricing.

What’s the Difference Between Spot and Futures?

Spot trades reflect current prices. Futures are contracts based on delivery at a later date.

How Does Leverage Work in Commodities?

Leverage lets you trade bigger positions with less upfront capital. QT offers up to 1:50.

Is Commodity Trading Risky?

Yes — prices can be volatile. Use stop-losses and trade size control to manage risk.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.