Advanced Multi-Timeframe Strategies: Trade Like a Fund Manager

Master the Strategies That Professional Traders Use Daily

You’ve come far in your trading journey, and now it’s time to unlock the next level. At Quant Tekel, we believe every trader deserves access to the same powerful techniques used by fund managers and institutional traders. Multi-timeframe analysis and correlation trading aren’t reserved for the elite – they’re tools that can transform your results starting today.

Today, you’ll discover how fund managers and institutional traders approach markets, and more importantly, how you can implement these same strategies in your own trading. Get ready to transform your approach and results.

The Multi-Timeframe Advantage

Professional traders never look at just one chart. They understand that markets are fractal – patterns repeat across different timeframes, creating powerful confluence zones that offer the highest probability trades.

Think of it like Google Maps: you need the satellite view to understand the terrain, the street view to navigate, and the traffic view to time your journey. Each timeframe serves a specific purpose in your trading decisions.

The Three-Screen Trading System: Your Professional Framework

Screen 1: The Trend (Weekly/Daily) – Your Strategic Compass

This is your big picture, where major decisions are made:

What to Identify:

- Primary trend direction (up, down, sideways)

- Major support/resistance levels

- Key moving averages (50, 100, 200)

- Long-term chart patterns

- Trend strength and momentum

Professional Approach:

- If weekly is bullish, only take longs on daily

- If weekly is at resistance, be cautious on longs

- Major levels on weekly trump everything else

- Weekly closes matter more than intraday noise

Example Setup: EUR/USD weekly showing:

- Above 200 WMA (bullish bias)

- Approaching major resistance at 1.1000

- RSI at 65 (room to run)

- Volume increasing (trend strength)

Screen 2: The Signal (4H/1H) – Your Tactical Entry Zone

This is where you identify specific trading opportunities:

What to Look For:

- Entry patterns (flags, triangles, breakouts)

- Momentum alignment with higher timeframe

- Volume patterns confirming moves

- Precise support/resistance levels

- Risk/reward optimization zones

The Professional Filter: Only take signals that align with Screen 1:

- Weekly uptrend = Only bullish patterns on 4H

- Daily at support = Look for reversal patterns on 1H

- Major resistance above = Take partial profits early

Advanced Technique: The 4H/1H Momentum Cascade

- 4H MACD crosses bullish

- 1H RSI breaks above 50

- Price breaks 4H resistance

- Volume confirms breakout

- Entry on 1H pullback

Screen 3: The Timing (15M/5M) – Your Precision Tool

This is where professionals separate themselves from amateurs:

Precision Entry Benefits:

- Minimize slippage on entry

- Tighter stop losses possible

- Better risk/reward ratios

- Psychological advantage

- Professional execution

The 15-Minute Edge:

- Find exact support/resistance

- Identify micro double bottoms/tops

- Spot absorption/distribution

- Time entries with market makers

- Avoid stop hunts

Professional Entry Checklist:

- [ ] Higher timeframes aligned

- [ ] Clear pattern on entry timeframe

- [ ] Volume supporting move

- [ ] Stop loss level identified

- [ ] Risk/reward minimum 1:2

Advanced Correlation Strategies: Think Like a Portfolio Manager

Understanding correlations multiplies your edge and protects your capital:

Positive Correlations to Exploit

Major Forex Correlations:

EUR/USD & GBP/USD (0.7-0.9 correlation):

- Move together 70-90% of time

- USD weakness benefits both

- Use for confirmation

- Split position between both

AUD/USD & NZD/USD (0.8+ correlation):

- Commodity currencies

- Risk-on/risk-off barometer

- China influence on both

- Excellent for pair trading

USD/JPY & US 10-Year Yields (0.85 correlation):

- Interest rate differential trade

- Rising yields = Rising USD/JPY

- Monitor bond market for forex signals

- Fed policy impacts both

Negative Correlations for Hedging

Classic Inverse Relationships:

USD & Gold (-0.7 correlation):

- Dollar weakness = Gold strength

- Inflation hedge dynamics

- Safe haven flows

- Portfolio diversification

EUR/USD & USD/CHF (-0.95 correlation):

- Nearly perfect inverse

- Use for hedging exposure

- Arbitrage opportunities

- Risk management tool

The Correlation Matrix Strategy: Professional Portfolio Construction

Build a portfolio approach that maximizes gains while controlling risk:

Portfolio Example 1: USD Weakness Theme

- Core Position: Short USD/JPY (40% allocation)

- Correlation Trade: Long EUR/USD (30% allocation)

- Commodity Play: Long Gold (20% allocation)

- Hedge: Small long USD/CHF (10% allocation)

Risk Analysis:

- Total USD exposure: Controlled

- Multiple ways to win

- Natural hedging built in

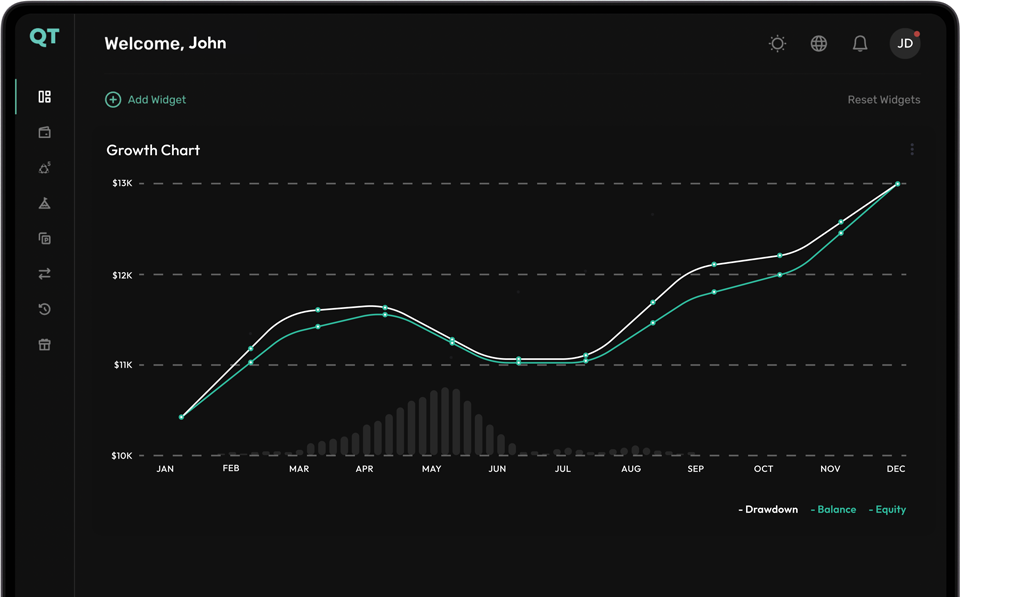

- Smooth equity curve

Portfolio Example 2: Risk-On Environment

- Core: Long AUD/USD (35%)

- Confirmation: Long NZD/USD (25%)

- Equity Correlation: Long USD/JPY (25%)

- Commodity: Long Copper futures (15%)

Advanced Entry Techniques: The Professional Edge

The Confluence Zone Method

Stack multiple confirmations across timeframes:

Requirements for A+ Setup:

- Weekly trend support

- Daily pattern completion

- 4H momentum trigger

- 1H precise entry

- 15M risk optimization

Real Example: GBP/USD Long

- Weekly: Uptrend, above 200 WMA

- Daily: Bounce from 50 DMA

- 4H: Bullish flag completion

- 1H: Break above flag with volume

- 15M: Pullback to breakout level

Entry: 1.2750, Stop: 1.2700, Target: 1.2900 Risk: 50 pips, Reward: 150 pips, R:R = 1:3

The Momentum Cascade Strategy

Trade when all timeframes align perfectly:

Bullish Cascade Requirements:

- Monthly: Price above 20 EMA

- Weekly: RSI above 50, rising

- Daily: MACD bullish cross

- 4H: Price breaks resistance

- 1H: Pullback to support holds

Why This Works:

- Multiple timeframe confirmation

- Momentum building across periods

- Institutional accumulation patterns

- Reduced false signals

- Higher win rate

Professional Risk Management for Multi-Timeframe Trading

Position Sizing Across Timeframes

Adjust risk based on holding period:

Time-Based Risk Allocation:

- Weekly setups: 0.5-1% risk (hold weeks/months)

- Daily setups: 1-1.5% risk (hold days/weeks)

- 4H setups: 0.75-1% risk (hold 1-3 days)

- 1H setups: 0.5% risk (intraday)

Why Different Sizes:

- Longer timeframes = larger stops

- More time exposure = more event risk

- Portfolio heat considerations

- Correlation adjustments needed

Correlation-Adjusted Risk Management

When trading correlated pairs, adjust position sizes:

Formula: Adjusted Size = Base Size × (1 – Correlation)

Example:

- EUR/USD and GBP/USD correlation: 0.8

- Normal position size: 1 lot each

- Adjusted size: 1 × (1 – 0.8) = 0.6 lots each

- Total exposure remains controlled

Maximum Correlation Rules:

- Never exceed 2% risk across correlated positions

- Maximum 3 correlated positions

- Monitor correlation changes daily

- Reduce in volatile markets

Real-World Case Study: The Perfect Storm Trade

February 2025 USD Reversal – Multi-Timeframe Analysis

The Setup Development:

Monthly Analysis:

- DXY at 10-year resistance (107.00)

- RSI divergence building

- Volume declining on rallies

Weekly Confirmation:

- Failed breakout above 107.00

- Shooting star candle formed

- Support breakdown at 105.00

Daily Trigger:

- Head and shoulders pattern

- Neckline at 104.50

- MACD bearish cross

4H Execution:

- Breakdown with volume

- Retest of neckline

- Bear flag forming

Portfolio Execution:

- Short USD/JPY

- Entry: 150.00

- Stop: 151.50

- Target: 145.00

- Size: 0.5% risk

- Long EUR/USD

- Entry: 1.0500

- Stop: 1.0400

- Target: 1.0800

- Size: 0.4% risk

- Long Gold

- Entry: $2,650

- Stop: $2,600

- Target: $2,800

- Size: 0.3% risk

- Short USD/CAD

- Entry: 1.3500

- Stop: 1.3600

- Target: 1.3200

- Size: 0.3% risk

Results:

- Total portfolio risk: 1.5%

- Average R:R: 1:3.5

- 3 of 4 positions hit targets

- Total return: +4.2% in 10 days

Advanced Tools and Technology

Leverage Quant Tekel’s professional features:

Multi-Chart Layouts

Professional Setup:

- 6 charts visible simultaneously

- Synchronized crosshairs

- One-click timeframe switching

- Custom workspace saving

- Multiple monitor support

Recommended Layout:

- Top left: Weekly chart

- Top right: Daily chart

- Middle left: 4H chart

- Middle right: 1H chart

- Bottom: 15M and 5M charts

Correlation Tools

Real-Time Correlation Matrix:

- Live correlation coefficients

- Heat map visualization

- Historical correlation charts

- Alerts for correlation breaks

- Custom correlation periods

Scaling Strategies: From Retail to Professional

The Journey to Consistent Profitability

Months 1-6: Foundation

- Master single timeframe first

- Add second timeframe gradually

- Focus on major pairs only

- Risk 0.5% per trade maximum

Months 7-12: Integration

- Implement three-screen system

- Add correlation awareness

- Expand to 3-5 pairs

- Increase risk to 1% per trade

Year 2: Advancement

- Full multi-timeframe mastery

- Correlation portfolio trading

- 8-10 instruments monitored

- Risk up to 1.5% per trade

Year 3+: Professional

- Institutional-style execution

- Complex portfolio management

- All asset classes available

- Dynamic risk adjustment

The Psychology of Multi-Timeframe Trading

Managing Information Overload

Common Challenges:

- Analysis paralysis

- Conflicting signals

- Timeframe confusion

- Overcomplication

Professional Solutions:

- Hierarchy of importance

- Clear rules for conflicts

- Simplified decision tree

- Regular strategy review

Maintaining Discipline

The Professional Mindset:

- Higher timeframe always wins

- Patience for confluence

- No forcing trades

- Trust the process

Advanced Techniques for Market Conditions

Trending Markets

Strategy Adjustments:

- Emphasis on higher timeframes

- Pyramiding positions

- Trailing stops loosely

- Correlation trades added

Ranging Markets

Strategy Adjustments:

- Focus on lower timeframes

- Fade extremes

- Tighter stops

- Reduce correlations

Volatile Markets

Strategy Adjustments:

- Wider stops required

- Smaller positions

- Fewer correlations

- Focus on majors

Your 90-Day Professional Development Plan

Days 1-30: Master the Basics

- Implement three-screen system

- Practice on one pair

- Journal every trade

- Focus on process

Days 31-60: Add Complexity

- Introduce correlations

- Trade 2-3 pairs

- Refine entry timing

- Analyze results

Days 61-90: Professional Execution

- Full portfolio approach

- Multiple correlations

- Advanced entries

- Consistent profits

The Quant Tekel Professional Advantage

We provide everything you need for institutional-grade trading:

Advanced Technology:

- Multi-screen capabilities

- Correlation matrices

- Professional indicators

- Institutional spreads

Expert Support:

- Fund manager webinars

- Advanced strategy sessions

- One-on-one mentoring

- Professional community

Growth Opportunities:

- Scale to $2 million

- 90% profit split available

- Institutional partnerships

- Career advancement

Final Thoughts: Your Evolution to Professional Trading

Multi-timeframe analysis and correlation trading separate professional traders from the masses. These aren’t just techniques – they’re a completely different way of seeing markets.

At Quant Tekel, we’re committed to your evolution from retail trader to professional. With our advanced tools, expert education, and supportive community, you have everything needed to trade like a fund manager.

Remember: every institutional trader started where you are. The difference? They learned to see the whole picture, manage correlations, and execute with precision. Now it’s your turn.

Ready to trade like a professional? Join Quant Tekel and discover why sophisticated strategies, advanced tools, and expert support create consistent success. Your evolution to professional trading starts here.

Take your trading to institutional levels with Quant Tekel. Access up to $200,000 in virtual capital, profit sharing up to 90%, and the tools that professional traders rely on. Your partner in achieving trading success awaits.