Trading

Crypto

Tap into the digital asset revolution. Trade 10+ leading crypto CFDs — Bitcoin, Ether, Litecoin, Ripple,

Dogecoin, and more — with razor‑tight spreads, leverage up to 1:100, and 24/7 market access.

Why trade Crypto

with quant tekel

Lightning-Fast Execution

Spreads are generally low making the trading cheap, and our sub-10ms execution ensures you never miss a move. Direct STP routing to 20+ tier-1 liquidity providers.

Ultra-Competitive Spreads

Access raw spreads from 0.0 pips on major pairs like BTC/USD and ETH/USD. Plus access to crypto crosses and indices like Crypto‑10 (top 10 by market cap).

Magnify Every Move

Tap into leverage up to 1:100, letting you trade larger positions with minimal capital—control risk with tight stops.

Go Long or Short

Profit from price rises and falls. No need for crypto wallets, just pure market speculation.

Regulated & Confidential

Your funds are held in segregated tier‑1 bank accounts. As with QT Forex, your capital remains secure — trade CFDs without custody.

24/7 Market Access

Crypto markets never sleep. Trade around the clock every day of the week — seize global opportunities as they happen.

Trade Every

Market Opportunity

BTC/USD

King of crypto

- Spread from 1.0 pips

- Most traded crypto pair globally

- High liquidity during US sessions

- Ideal for swing traders, scalpers, and trend followers

ETH/USD

Smart-contract pioneer

- Spread from 0.1 pips

- Powers DeFi, NFTs, and Web3 ecosystems

- Volatile around major Ethereum upgrades

- Ideal for high-volatility strategies and short-term setups

LTC/USD

Streamlined payments

- Spread from 0.0 pips

- Lower transaction fees, faster

block times - Traded as a BTC proxy in some market cycles

- Great for intraday trend strategies and breakout plays

XRP/USD

Ripple’s fast settlement

- Spread from 0.2 pips

- Central to cross-border remittance tech

- Reacts to news on Ripple’s SEC legal outcomes

- Useful for event-driven trading and risk offsets

Your Crypto Journey

Begins Here

At Quant Tekel, we provide aspiring traders with the resources they need to succeed. Our innovative programs are designed to elevate your trading journey.

Step 1

Choose your account

Choose from Standard, Prime and Elite account, depending on your trading preferences to get started

Step 2

Select Your Platform

Select from Tradelocker, MT5, or cTrader. All platforms are completely available to use for trading.

Step 3

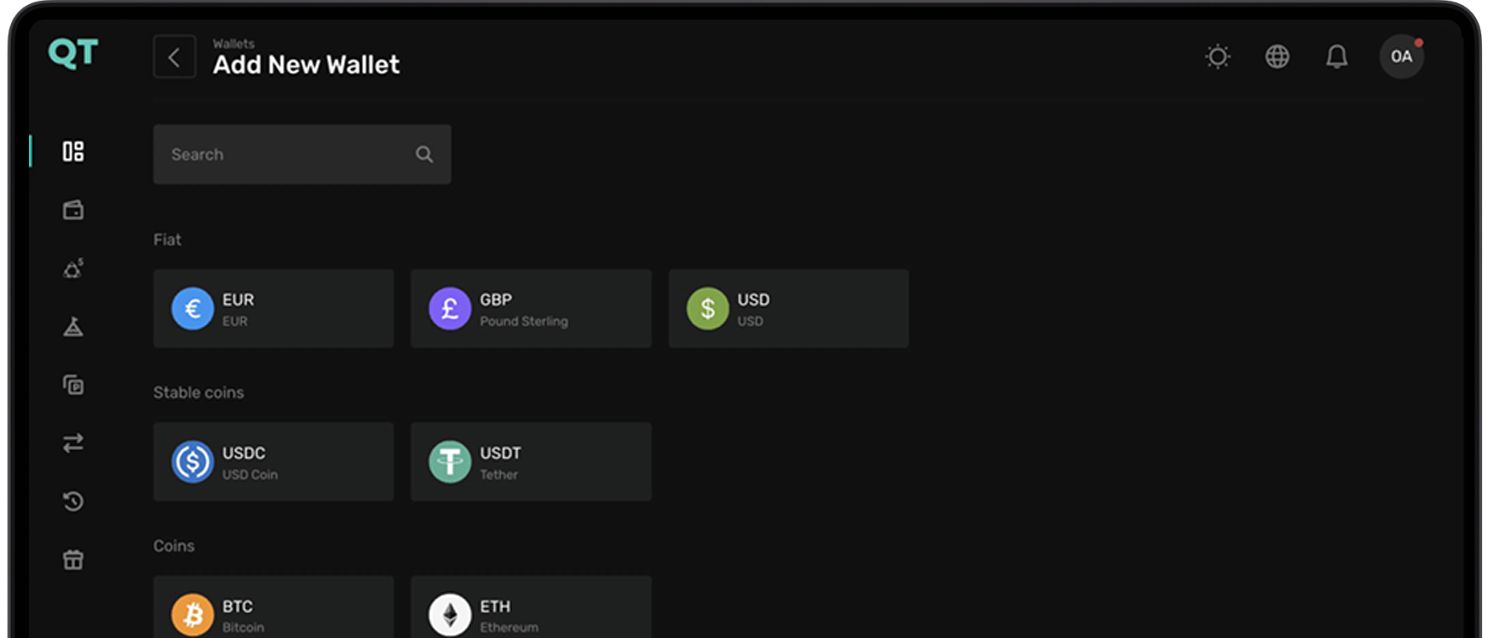

Fund Your Account

Enjoy a variety of deposit methods that offer instant processing. You can begin with an initial deposit of just $200.

Step 4

Start Trading

Gain immediate access to over 80 currency pairs and 24/5 market access. Your exciting trading journey starts right now!

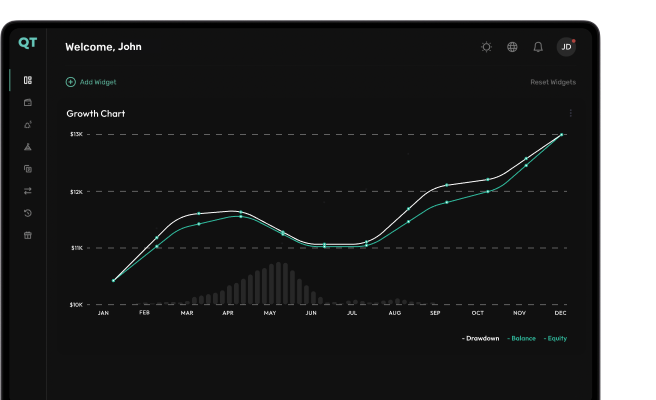

Everything you need

to make it in the markets

- Beginner’s Guide

- Technical Analysis

- Fundamental Analysis

- Risk Management

What is Crypto trading?

It’s trading digital assets like Bitcoin and Ethereum — no wallets or ownership needed.

How do pairs work?

You’re trading the price difference between two assets, e.g. BTC/USD or ETH/USDT.

What moves crypto prices?

News, regulation, adoption trends, and blockchain upgrades all influence volatility.

What is crypto slippage?

It’s when a trade is filled at a different price than expected due to fast market moves.

How does leverage work in crypto?

Leverage lets you trade more with less capital. QT offers up to 1:100 on major coins.

Is crypto trading safe?

It’s volatile and high-risk — but tools like stop-losses and position sizing can help manage exposure.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.