Trading

Forex

Dominate the $7.5 trillion daily forex market with institutional-grade execution. Trade 80+ currency

pairs with raw spreads from 0.0 pips and leverage up to 1:100.

Why trade Forex

with quant tekel

Lightning-Fast Execution

Spreads are generally low making the trading cheap, and our sub-30ms execution ensures you never miss a move. Direct STP routing to 20+ tier-1 liquidity providers.

Institutional-Grade Spreads

Access raw spreads from 0.0 pips on major pairs like EUR/USD and USD/JPY. Backed by a low-commission model, you trade with pricing built for serious performance.

Maximum Leverage Power

By borrowing money from a broker, investors can trade larger positions in a currency – up to 1:100 leverage available across all major, minor, and exotic pairs.

No Trading Restrictions

Trade your way with zero limitations — scalping, news trading, hedging, and EAs are all fully supported, with no minimum hold times enforced.

Regulated & Secure Platform

Your funds are held in segregated accounts at tier-1 banks. Trade with peace of mind knowing your capital is protected by

industry standards.

24/5 Global Market Access

Trade around the clock across three major sessions – Asian, European, and American. The forex market never sleeps, and neither do your opportunities.

Trade Every

Market Opportunity

EUR/USD

World’s most traded

- Spread from 0.0 pips

- $1.1 trillion daily volume

- London/New York overlap

- Perfect for all trading styles

GBP/USD

The Cable

- Spread from 0.1 pips

- High volatility opportunities

- Sensitive to UK Economic data

- Ideal for day traders and scalpers

USD/JPY

The Yen Cross

- Spread from 0.0 pips

- Asian market exposure

- Safe-haven currency dynamics

- Great for trend following strategies

USD/CHF

The Swissie

- Spread from 0.2 pips

- Swiss franc stability

- Negative correlation with EUR/USD

- Perfect for risk management

AUD/CAD

The Aussie

- Spread from 0.2 pips

- Oil price correlation

- North American focus

- Ideal for commodity traders

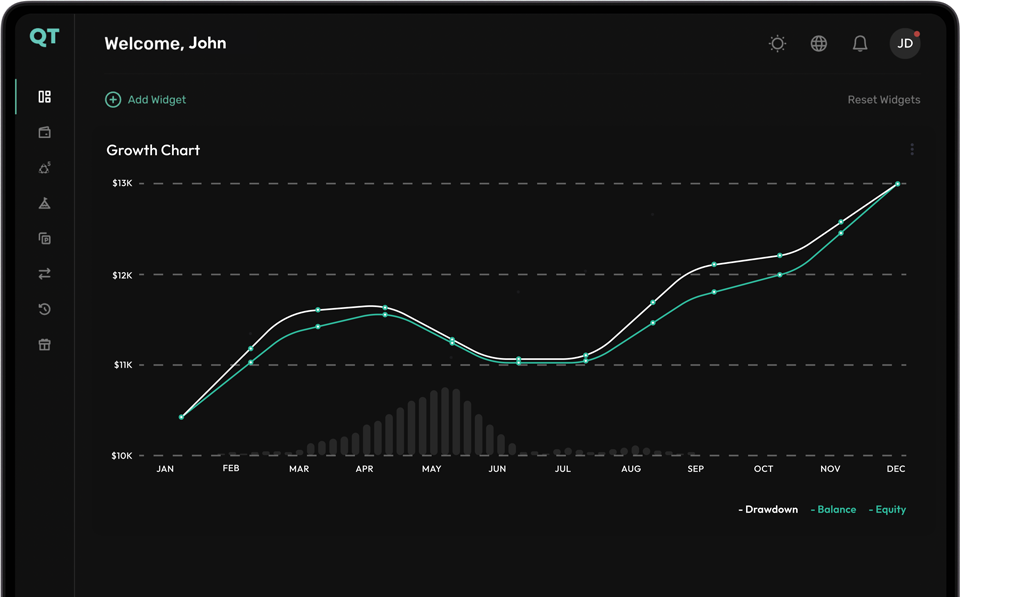

Join 60,000+ Traders Already

Profiting with QT

At Quant Tekel, we provide aspiring traders with the resources they need to succeed. Our innovative programs are designed to elevate your trading journey.

Step 1

Choose your account

Choose from Standard, Prime and Elite account, depending on your trading preferences to get started

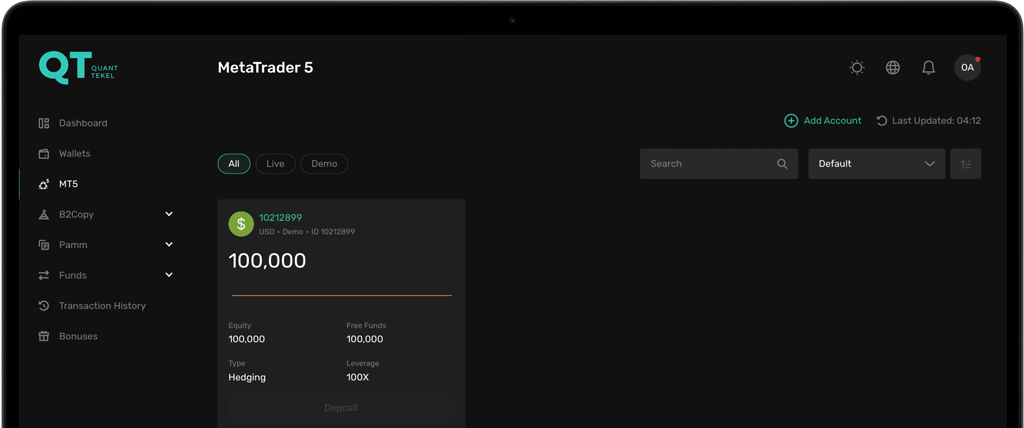

Step 2

Select Your Platform

Select from Tradelocker, MT5, or cTrader. All platforms are completely available to use for trading.

Step 3

Fund Your Account

Enjoy a variety of deposit methods that offer instant processing. You can begin with an initial deposit of just $200.

Step 4

Start Trading

Gain immediate access to over 80 currency pairs and 24/5 market access. Your exciting trading journey starts right now!

Everything you need

to make it in the markets

- Beginner’s Guide

- Technical Analysis

- Fundamental Analysis

- Risk Management

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:100.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.

What is Forex?

It’s the global market for trading currencies — the largest, most liquid market in the world.

How do pairs work?

You’re buying one while selling another. EUR/USD means buying euros, selling dollars.

What moves forex prices?

Interest rates, economic data, geopolitical events, and central bank policy drive currency movements.

How does leverage work

in forex?

Leverage lets you trade bigger positions with less capital. QT offers up to 1:500.

Is forex trading risky?

Yes — leverage increases both gains and losses. Smart risk management is essential.

What are pip values?

Pips measure price movement. They help you calculate profit/loss per trade.